Visualized: Biotech’s Economic Footprint in Europe

EuropaBio, Europe’s biotech industry association, has issued a 2023 update to their report on the biotech industry’s economic footprint in Europe (research done by the Darmstadt-based WifOR Institute). The publication has lots of nice infographics giving a direct sense of biotech’s impact in the European Union and the United Kingdom.

As we can see below, biotech is dominated by medical applications, although industrial applications (e.g., bioenergy, bioplastics, or other materials) are not negligible. The situation is similar in the U.S., with the addition of biotech crops, which are virtually non-existent in the European Union.

Interestingly, agricultural biotech is growing the fastest, albeit from a very low base. This might be also due to the growth of non-crop biotech applications, such as lab-grown meat or precision fermentation (e.g., using gene-edited microbes to produce animal-free cheeses, egg, or other alternative proteins).

Job growth since 2017 has been strong:

A growing share of medicines are made through biotech instead of chemistry. Biologicals are medicines grown and then purified from large-scale cell cultures of bacteria or yeast, or plant or animal0 cells. These include vaccines among others.

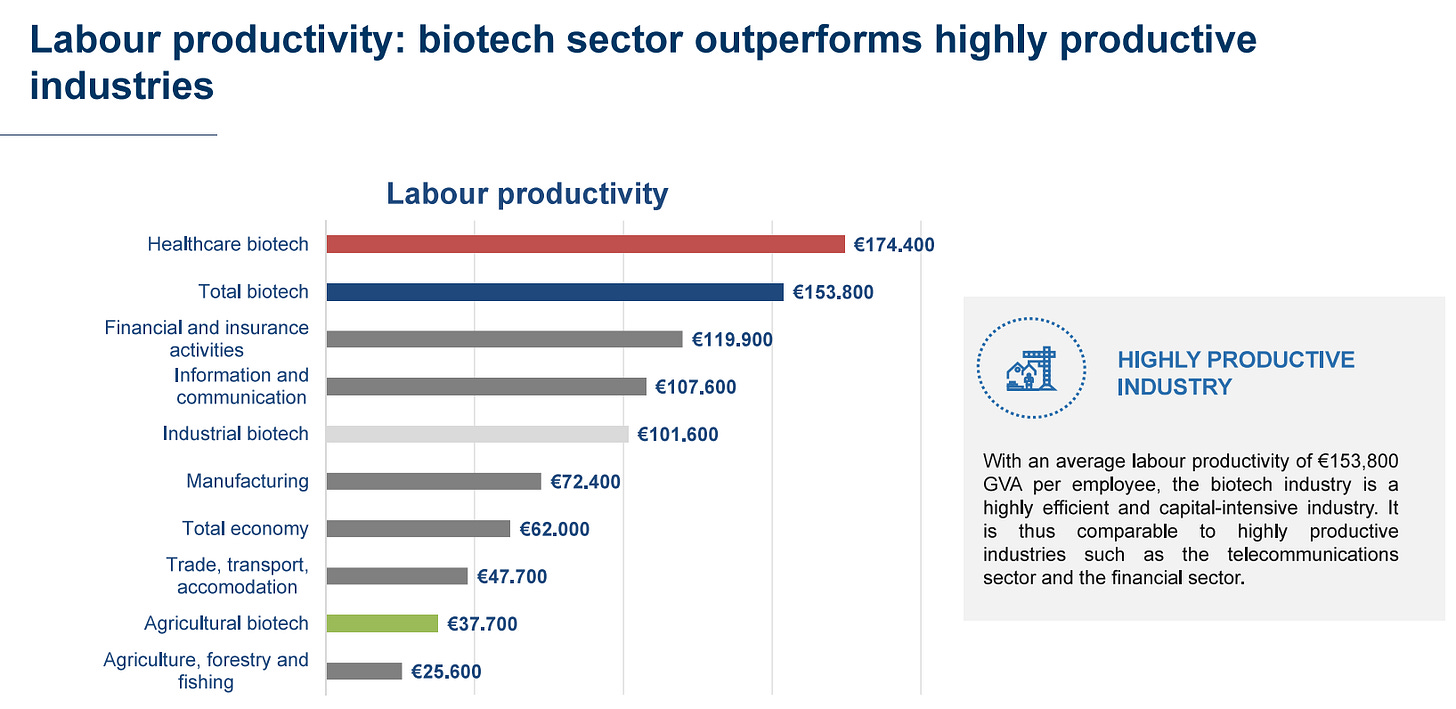

Biotech is a highly productive and capital-intensive industry:

Biotech is an important driver of European exports (I am told one area where sanctions against Russia have hurt is in reducing access to European medicines):

WifOR estimates biotech has an even bigger role indirectly supporting revenue and employment in other sectors:

The report also helpfully includes the major concrete products we are taking about:

And for agricultural biotech:

The headline figure for biotech’s direct economic impact in Europe (€34.5 billion) is surprisingly low, especially as compared with the U.S., where a figure of around €1 trillion is often mentioned. This may be due to the difficulties of measuring the sector and to differing definitions. (The term “bioeconomy” for instance means something radically different in the U.S. and much of the rest of the world, but I won’t get into that here.) EuropaBio’s previous iteration of the study provides U.S.-EU figures that give a sense of the actual biotech disparities between the Old and New Continents:

The European biotech sector is set for continued growth greater than that of the broader economy and the development of important medical and industrial applications. It will be interesting to see, with the growth of alternative proteins, the post-Brexit UK’s embrace of agricultural biotech, and the probable legalization of New Genomic Techniques for crops by the EU, whether the share of agricultural biotech will grow to significance. Both agricultural and industrial applications of biotech are likely to be important for sustainability.